By JRK

MODINOMICS – Another Big Bang

Prime Minister Narendra Modi has made it – his name figures in the annual list of ‘100 most influential people in the world’ of Times Magazine. He has 29.2 million followers in Twitter, and over 40 million in Facebook. He has become a cult figure – a strongman – saviour. Now ‘Howdy Modi’, watched by one-billion people all over the world, was unprecedented in which Trump was trumped in the game of one-upmanship. Today, a school-going child knows Houston is the capital of Texas but he may look askance if asked about the Capita; of Mizoram. It is not that approbation is unquestioned.

Some also revile him. But you cannot ignore the man. He is in your bedroom reminding you about birth control exhorted in ‘Mann Ki Baat’, in drawing room; you find Arnab and his ilk screaming at anti-nationals – disparagingly referred to as ‘tukde tukde’ gang. Interestingly, one former PM and Vice-president was named as part of that gang – it is incomprehensible how the ruling dispensation benefited from encouraging anti-national sentiments.

The first Big Bang in Modinomics was Demonetisation. One fine evening, you found the big currency notes in your pocket and cupboard ceasing to be legal tender within hours. You did not know how to exchange and where to exchange – but you were applauding the move because you were told that it was a small pain for rooting out Black Money tucked in the almirahs of corrupt. You were standing in long queues before ATMs and Banks without grumble, even parting with a little wealth as you could not remember the few notes kept with care in some almirah at home. Ultimately, we were told that 95% of the demonetized notes came back to RBI. Demonetization was a self-inflicted injury crippling small industry and small business which ran on cash. Coupled with that, beef ban which was a significant contributor to export got destabilized and around 30 lakh people slipped to unemployment.

The second one was Goods and Services Tax with lofty objective of ‘one nation, one Tax’. On paper, it was perfectly a bold reform – with 17 taxes and cesses being replaced with 4 slabs. It was ushered in a midnight session of Parliament – it was Modiji’s ‘Tryst with Economy’ after that famous Midnight session heralding our independence with the famous words ‘Tryst with Destiny’ by Nehru. But the implementation was hasty – the small traders, small textile producers being biggest sufferers. The slabs on products have no scientific basis, the site has several glitches, the forms are complex and there are long waits for refund wiping out the low margins. MSMEs and Startups continue to be haunted by GST. Further an angel tax was introduced which resulted in preventing investors from putting their money on fledgling Startups.

The New Deal

The last 6 years have contributed to worst slowdown. Unemployment is at a 45-year high and growth in disposable income of individuals personal income available for consumption or savings after paying taxes has fallen as per report of National Statistical Office. The debt-driven consumption worked for a while with Banks switching over to retail segments, but that the story is over with repayment capacity stagnating. India’s economy had annualised growth of 5% in the April-June quarter slowest in more than 6 years dragged by weak consumer demand and private investment.

Finally, humility is appearing to replace hubris. We had just witnessed the boldest reform in sharp reduction in Corporate Tax. The tax rate for domestic companies stands reduced to 25.17% (inclusive of reduced surcharge of 10%) irrespective of turnover thresholds and nature of activities provided taxpayers do not opt for any tax incentives. Further new manufacturing companies i.e., those incorporated on or after October, 2019 are subject to effective tax rate of 17.16% (inclusive of reduced surcharge of 10%) provided the commencement of production starts before March, 2023. It should have come in the budget as the revenue foregone is around Rs1.45 lakh crores, but the present dispensation does not care a hoot for nuances. We have witnessed Press conferences wherein important decision is being announced.

The unexpected reduction in Corporate Tax is first after Dream Budget of 1997 the architect of which is ironically in Tihar jail. He was worried about economic slowdown before going to jail and now he would be a relieved man though political expediency may compel him not to be forthcoming. The greenhorn novice FM has outsmarted him by the boldest initiative. The Sensex rose by more than 2000 points, the biggest gain in a single day in last 10 years which speaks of the gloom and doom that prevailed in the economy. It was a surprise Diwali gift even without any demand. V. K. Vijay Kumar of Geojit Financial Services compared it to ‘New Deal’. The ‘New Deal’ of Roosevelt had resurrected American economy from Great Depression. But there is a deep difference – ‘New Deal’ was an attack on recession through demand side while our FM has picked supply side.

Lower corporate tax will lead to earning benefit of 11-12% for capital goods, metals, banks, automobiles, consumer durables; 10% benefit for infrastructure, fast-moving consumer goods makers; 5-7% for real estate, non-bank lenders, logistics and 4% for cement according to Philip Capital. There is negligible impact on IT and pharmaceuticals.

Earlier, India’s headline corporate tax rate was among the highest in South Asia. Now with base tax rate coming down to 22% (15% for new investment in manufacturing) India has one of the lowest corporate tax in the region. China and Korea has 25%, developed countries like US has 21%, UK 19% and Japan 23.2%. If we only take into account new Companies which would come into existence, it is supposed to be the lowest in the world.

The additional funds would be utilised for CAPEX, and some surplus would go to consumers through reduction of price. The measure would revive animal spirit. Old Companies can open up new subsidiaries to get the benefit of 15% tax rate. More important, it would attract huge foreign investment. US-China trade war has opened up tremendous possibilities and our foreign policy should be aligned so as to keep the tension alive. Once the foreign companies set up bases, they can not move out. The tax rate cut should be followed up by labour reform and infrastructure improvement. India has a dismal position in ‘Ease of doing business’ index. There must be good governance and just-in-time governance.

India has leapfrogged from an agrarian economy to Services sector in the first flush of liberalisation. However, India is no Singapore and a big country can not sustain without manufacturing. The Govt initiative of ‘Make in India” campaign had aimed at redressing it by raising share of manufacturing sector to 15% of GDP from 11%. The rate cut should give a boost to the campaign.

Fiscal Deficit

There is a catch. The results would show only in medium term if and only if, everything fall into place. Indiraji had once made a loud thinking about committed judiciary and there were howls of protest for years together. But today we have got a committed RBI, committed Press who are completely aligned with the Government for ‘national interest’. RBI parted with Rs. 1.76 trillion which should take care of the shortfall in the current FY. Further the Govt has plans to raise Rs1.05 lacs crores through disinvestment in PSUs. The economy can chug along with this bonanza.

But Modiji has ambitious plans in welfare economies and some vainglorious. Full-fledged roll-out of Ayushman Bharat should entail expenditure of Rs10000 crores annually and pension scheme for unorganized sector should cost some thousand crores. These are drags on economy which, however, has to be undertaken for the poor and marginalized.

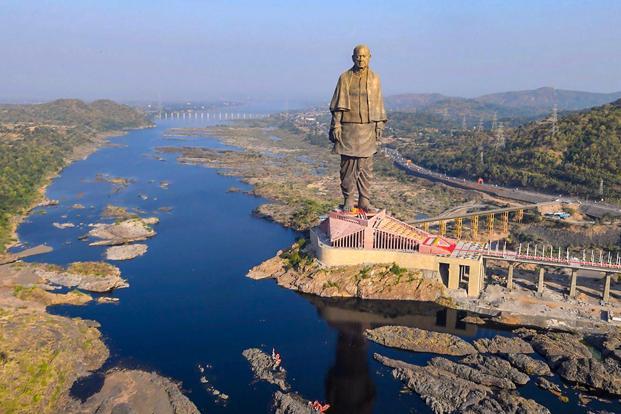

However, statue of Sardar Patel which cost about Rs4000 crones and recent announcement of 1 billion line of credit to Russia defies logic, we were doing charity to Least developed Countries but assisting a developing country while we are going through resource crunch is unwise.

Modiji has recently expressed his desire to quit politics in 2029 and retire to Himalayas as an ascetic. He has just secured a landslide victory with the hope that he would be a transformative leader bettering the lives of millions. With virtually no opposition, he would be at the helm till 2029. With raucous democracy taking a back seat, he has the freedom to walk the talk. He has promised to make India a 5 trillion economy from 3 trillion at present. He has to act fast – doable things must be immediate.

(JRK is a Kolkata based Economic & Political Analyst)