Pradeep Kumar Panda

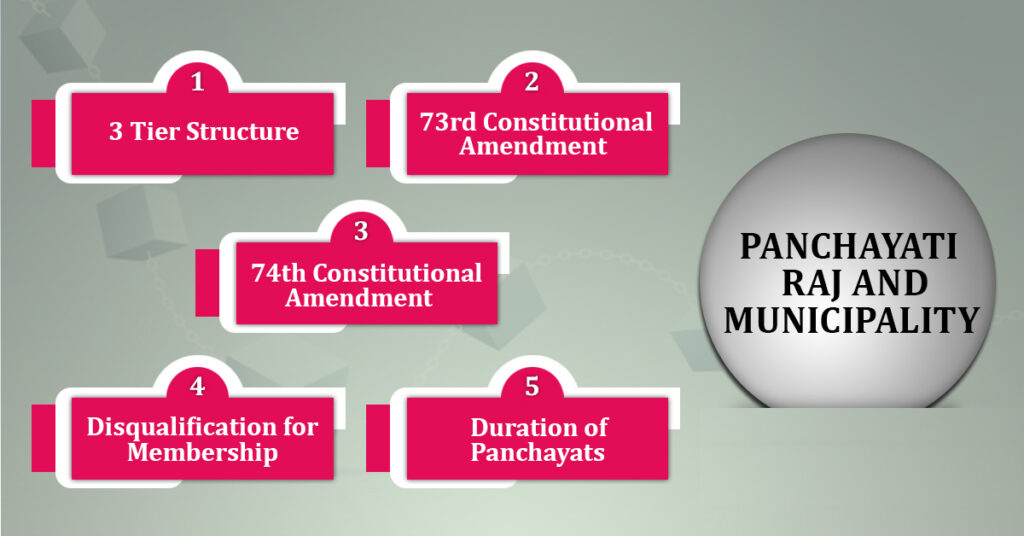

India is a federal parliamentary democracy. The panchayats and municipalities are seen as the ‘third tier’ of government. This has also made India the most representative democracy in the world. Today, about 2.2 million representatives stand elected to the three rungs of Panchayats and three levels of municipalities.

Under a framework of cooperative federalism, a trend has been noted in many developing countries in the last three decades towards increasing decentralization of the public sector. The period has witnessed a significant rise in local democracy with growing realization that devolution of political, administrative and fiscal authority to local units of government is one of the best ways to deepen democracy and increase efficiency.

It was also felt that responsibilities for expenditure be devolved with concomitant revenue to maintain fiscal accountability. Seemingly, this shift along with privatization and deregulation has reduced the authority of national governments over economic policies. India is also keeping pace with this trend. New systems of local and intergovernmental finance are being established as part of the evolution. The trend has been noted, particularly since early nineties with the passage of 73rd and 74th Constitutional Amendments that accelerated the process of decentralization with greater devolution and delegation of powers to local governments and the recognition of panchayats and municipalities in the book of statute as institutions of self-government.

Consequently, Part IX and IX A have been inserted into the Constitution for Panchayats and Municipalities respectively and State legislature has been made responsible to transfer functions, listed in the newly created Eleventh Schedule and Twelfth Schedule. The State is also required to transfer the interrelated powers to enable them to carry out the responsibilities conferred upon them.

Under the Constitution Amendment Act (CAA), the state legislature is authorized to devolve the specific responsibilities, powers and authorities to the local governments to enable them to function as institutions of self-government. The legislature of a State may both empower the rural and urban local governments to levy, collect and appropriate certain taxes, duties, tolls and fees, etc., and also assign to them the revenues of certain state level taxes subject to such conditions as are imposed by the state government.

Further, grants-in-aid may also be provided to these local governments. Resulting from the CAA, the numbers of Panchayats as on March 2014 stood at 247467 of which 240542 are Gram Panchayats, 6332 are Block Panchayats and 593 are Zila Panchayats. On the other hand, Municipalities by the end of December 2015 numbered 4041 in all States.

Fiscal arrangements necessitate every State under Article 243 I and 243 Y to constitute, at regular interval of five years, a state finance commission (SFC), and assign it the task of reviewing the financial position of local governments and making recommendations on the sharing and assignment of various taxes, duties, tolls, fees etc and grants-in-aid to be given to the local governments from the consolidated fund of the State. The conformity Acts of the CAA provide for the composition of the commission, the qualifications for its members and the manner of their selection. Every recommendation of the commission together with an explanatory memorandum is to be laid before the legislature of the state.

It is about two and a half decades since Part IX and IX A were incorporated into the Constitution. During the period, one could have found enough reasons to cheer. Conformity Acts have been enacted in all the States. Elections have been conducted in all. Women have been elected as Mayor for city government and Sarpanch for rural local government. All States have constituted their SFC. Most States have received their fourth-generation SFC recommendations . Notwithstanding, local governments in almost all States continue to be starved of finances causing major impediment in their growth and effective functioning. The problem is compounded when it is seen with the expanded role and responsibilities of the local governments after CAA became effective and the 11th and 12th Schedules were inserted.

Ideally, the functional responsibilities should closely be linked with the financial powers delegated to the local government. In practice, huge mismatch between these two exists leading to a severe fiscal stress at the local level. Own revenues of local governments are generally adequate to meet only a part of their operation and maintenance (O&M) requirements. Therefore, they are dependent on the higher level of governments to finance their activities. The SFCs are responsible to examine not only the revenue-sharing arrangements between the State governments and the local governments, both rural and urban, but also the entire range of subjects concerning assignment of taxes, transfers of power and such other subjects for improving the financial health of local governments. In this case, the CAA does not draw any distinction between the plan and non-plan financial requirements of the local governments. Therefore, SFCs are not confined only to the assessment of non-plan expenditure of the local governments for recommending the devolution of funds and financial powers to the local governments at various levels.

Article 243G of the Constitution empowers Panchayats to function as institutions of self-government for the purposes of (a) preparing plans for economic development and social justice for their respective areas and (b) implementing schemes for economic development and social justice in their respective areas for various subjects including those twenty-nine functions listed in the Eleventh Schedule. However, the list is merely illustrative and indicative. Unlike the division of powers and functions, as spelled out in the Union and State List in the Constitution, no such clear demarcation exists between the State and Panchayats. It is for the State Legislature to make laws regarding the devolution of powers and functions upon the Panchayats.

Though, almost all states and union territories (UTs) have claimed that they have transferred subjects in varying degrees to the Panchayats, by enacting laws in conformity with the CAA, functional domain of Panchayats pertains to only traditional civic functions in several states. Functional domain is without adequate developmental responsibilities in those states where either the intermediate Panchayats or the District Panchayats were absent for decades. States, where they existed for long, have only repeated the provisions of the old statutes in their new laws with marginal adjustments. Moreover, many State Governments have not framed the relevant rules or guidelines as a follow up measure. A few States realized that transfer of additional functions would accompany the concomitant funds and functionaries to local governments, enabling them to perform the specified responsibilities. At the same time, the local governments are also not very clear about the role they are expected to play in the new federal set up. The fact of the matter is that almost all the subjects enumerated in the Eleventh Schedule are State-concurrent, involving duplication and overlapping.

Another challenge before the State Government has been the identification of activities to the appropriate tier of the three-tier-panchayat system. Traditionally, the lowest level panchayat, i.e. the village panchayat (VP) has been the most active in almost all States. Generally, the VPs carry out major functions including core functions whereas intermediate and district panchayats in most States are assigned supervisory functions or act mainly as executing agents for the state government.

It is a general perception that Panchayats are financially and technically under-equipped to perform even the core functions, not to speak of the welfare functions and other economic functions related to agriculture and industries. Hence, many of the core functions, which traditionally belonged to local governments like, drinking water, rural roads, street lighting, sanitation, primary health etc. have not been transferred fully in some states and are being performed by the line departments of the State Government or the parallel parastatals.

The SFCs have a major role to ensure that the democratic decentralization envisaged under the CAA becomes operational and effective. The State Governments have the responsibility to enhance the credibility and acceptability of the SFCs. It is the State Government that has to enact a conformity act prescribing the number and qualification of members of the Commission. It is unfortunate that most States have considered the appointment of SFC as one of the instruments through which they can please or appease the group of favourites whether from bureaucracy or from outside. It is interesting to note that the composition of the SFCs, including the chairperson, varied between two to five persons that too varied from full time to part time or the mix of both. In many States, SFC report is submitted to the State Government and not to the Governor. In addition, the institution of SFC is further weakened in the absence of firm database on local governments and norms for service delivery. Diverse views, channels and methods of State-local fiscal transfers make their task even more challenging.

In such surroundings, many SFCs, over a period of time, produced second-rate reports without spelling out the principles on which their recommendations are based. Literature, studies and even theoretical models were mentioned without relating to practice. In other words, the chapter on “conceptual framework” or “issues and approach” is not attuned to other chapters including the chapter on recommendations.

It goes without saying that the endowment of financial powers and authority are to be matched by the functions and responsibilities. Most SFCs barely looked at the functional domain of the local governments as envisaged in the 11th Schedule and hardly considered the potential resource generation of Panchayats while making recommendations for the devolution of funds from the State government to them.

Given the heavy non-plan developmental tasks the local governments have to perform, the assigned taxes and non-tax revenue sources are unlikely to be adequate. Moreover, the revenue generating capacities of local governments, whatever is their level; differ from State to State and even within the State. Some have high revenue potential and some have low. Similarly, cost factor in providing services also differs for various reasons including cost disability factor, e.g. area under forest or desert.

Intra-state variations postulate the need for an equalization transfer mechanism through SFCs that assess the needs of the local governments as well as their efforts to tap their own revenue potential. This kind of normative assessment by the SFCs should have been to ensure the fulfillment of every citizen’s entitlement of basic minimum service or a set of local public goods. Unfortunately, such an issue has either not addressed or attempted amateurishly in most SFC reports.

It is expected from any finance commission, be it a Union or state, to evolve a mechanism so that a fine blend of equity and efficiency objectives can be achieved in fiscal transfers. Only this kind of devolution mechanism can promote autonomy. A system of rewards and punishment has to be developed in the State and the SFCs have to initiate and evolve this mechanism. However, a very few SFCs made its recommendations in that direction.

Most SFCs have recommended a medley of taxes, cesses, or even surcharge on State taxes. Given the fact that collection of taxes at the local level is difficult, such type of efforts lead only to the escalation of administrative cost as each tax requires tax collection machinery. At times, cost of collection exceeds the actual collection of a particular tax. In order to strengthen the revenue base of the local governments, SFCs could have recommended measures to tighten tax administration for better compliance of existing taxes, rationalization of taxes and recovery of cost through appropriate user charges. After the CAA, most states made not much change in their existing laws related to Panchayats. Panchayat laws are fragmented in some states. .

Like Union Finance Commission, SFC’s recommendations are recommendatory not mandatory in nature, but unlike Union Finance Commission, SFC’s recommendations are occasionally honored. In fact, many states are making a mockery of the constitutional provision. On the one hand, they constitute a body with people of little knowledge on public finance; on the other hand, they do not even consider the report. If the report is considered, very few recommendations are accepted. In the process, the crucial ones are rejected without assigning reasons. In the action taken report in some states, only numbers are mentioned. In this number game, sometime the most crucial recommendations are found rejected surreptitiously. At the top of it, many times, the accepted recommendations are not implemented. Sometime, money is not released even though actions on these recommendations are notified. The story becomes more interesting given the fact that a state Government took three years to only consider the report of the SFC.

Since State Governments do not consider the recommendations of the SFC in time, the major problem regarding the synchronization of the periods of SFC with that of the Union Finance Commission (UFC) arise. All UFCs – from the Tenth to Fourteenth – felt the absence of SFC reports as a handicap. All UFCs, though, had the reports of SFC’s of most States but these were of different period of time period covered by the concerned UFC. For this very reason the Eleventh Finance Commission even went to the extent and recommended to delete the words “on the basis of the recommendations made by the Finance Commission of the State” appearing in sub-clauses (bb) and (c) of Article 280 (3) of the Constitution. Subsequent Finance Commissions, including the 14th Finance Commission, endorsed views of previous commissions on this issue.

The institution of SFC is evolving over a period of time as evident from a few good SFC reports and their treatments by respective state governments in recent time. The working of SFCs could be improved further through a concerted efforts of Union and State governments as well the SFCs themselves. Suggestions in that direction are outlined below:

Through such concerted efforts there would be some uniformity in

(a) SFC reports,

(b) local budgetary classifications,

(c) definitions of local taxes & expenditures,

(d) fiscal transfer mechanism to local procedures for data collection etc.

Considering the feeble own revenue base of the local governments so far, and its high dependency on higher level of governments, the recommendations of State Finance Commission have to be of utmost importance to the local governments. Since all available SFC reports are different to each other with reference to their approaches and methodologies and even the time period covered by them, it is extremely difficult, to standardize these recommendations. Moreover, some SFCs have access to data, some have not and reliable data on panchayat and municipal finance are still not available from any source. In such circumstances, it is a challenge to the best brain to analyze the impact of SFC recommendations on the finances of local governments. It is clear, from the progress report of the last two and half decades that though the stipulation of SFC is an innovative and significant feature of the CAA, it lacks teeth and substance.

(The author is an economist based in New Delhi. Views are personal.)