Gopabandhu Mohapatra

Recently, news items published in a section of the media is in wide circulation regarding the reported move to privatize some of the Banks and to permit more and more private capital into the banking sector. In the name of banking reforms and measures, the Government wants to de-nationalize and privatize, by handing over the public sector banks to the private corporate.

This is not the first time that the idea of merging state-owned banks has gained momentum. In the past, Mr. M. Narasimham, a former governor of Reserve Bank of India in his 1991 report on banking sector reforms, had recommended mergers to form a three-tier structure with three large banks with an international presence at the top. Eight to ten national banks at tier two, and a large number of regional and local banks at the bottom.

Indeed, according to Indian Banking Association data, there have been at least 49 mergers since 1985. Here is a quick look at a few of them. Punjab National Bank (PNB) and New Bank of India (NBI) (1993-1994). This was the first ever merger between two nationalized banks. New Bank of India, which was nationalized in 1980, was loss making and its capital and deposits had eroded.

Bank of Baroda (BoB), bailed out the Uttar Pradesh-based Benares State Bank Ltd (2002), a private sector lender which had been incurring losses. BoB gained 105 branches and a small customer base. Oriental Bank of Commerce (OBC) and Global Trust Bank (2004); It was proposed in order to protect the interests of the depositors of GTB. The bank had suffered massive losses and its net worth wiped off. The merger allowed OBC, a public sector bank to expand in south India and gain a million depositors.

State Bank of India and State Bank of Saurashtra (2008), this was the first of the seven mergers between SBI and its associate banks. Two years later, State Bank of Indore was integrated. The government issued a directive in June 2016 asking SBI to complete the merger of the remaining five Associate Banks and Bharatiya Mahila Bank with State Bank of India by April 2017. With the mergers, SBI gains a spot among the top 50 globally recognized banks.

Between 1993 and 2020, there were few Public Sector Banks, who have acted as saviors for some Private Sector Banks, in retaining the image of the Banking Industry. They were (a) during 2003, Kerala based Nedungadi Bank Ltd, 106 years old Private Sector Bank was taken over by Punjab National Bank; (b) Western Maharashtra based United Western Bank Ltd was taken over by IDBI Bank during 2006; (c) Recently, in 2020, it was State Bank of India, who came forward to bail out the new Generation Private Sector “Yes Bank”. (d) Furthermore, IDBI Bank was privatized with Life Insurance Corp owning a majority stake

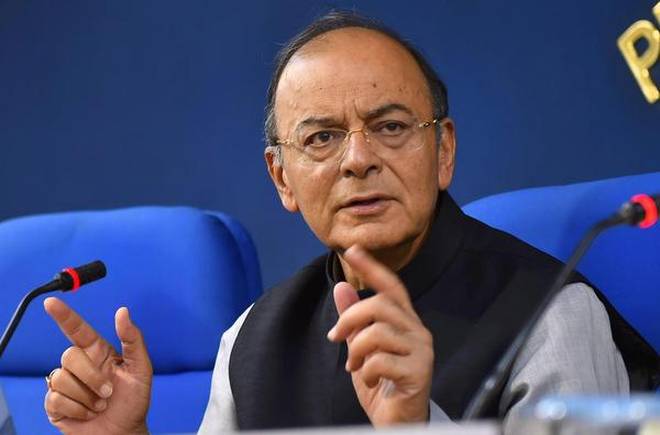

During 2019, there was a real reorganization. To strengthen the position of Public Sector Banks, Mr. Arun Jaitley, Finance Minister on September 17, 2018, announced the merger of the three banks was effect from 1st April 2019. Dena Bank and Vijaya Bank were merged with Bank of Baroda (BoB). The combined entities became the 3rd largest bank of the country, with a combined business of Rs 14.82 lakh crore. The merged entity will have 9,489 branches.

Just one year after, the finance minister Ms. Nirmala Sitharaman in a press conference on August 30, 2019, declared a fresh round of mergers of 27 public sector banks with varying health and cultural diversities announced to 10 PSBs. With this, the 27 public sector banks, which were existing in 2017 will be reduced to 12 after the mergers are implemented.

The merger of Punjab National Bank, with Oriental Bank of Commerce and United Bank to create India’s 2nd largest lender. The merger of Canara Bank with Syndicate Bank will create the 4th largest public sector. This lender will have a total business size of Rs 15.2 lakh crore and 9,609 branches. With the merger of Andhra Bank and Corporation Bank with Union Bank of India as the anchor lender, it creates the 5th largest public sector bank. The merger between Allahabad Bank and Indian Bank will result in the 7th largest bank.

After the above mergers, the Market Share of Top 10 Indian Banks, including Private sector Banks are as follows

The mega merge, however, has left six other banks untouched. Some analysts say these banks could be future merger candidates once their balance sheets are healthier. The untouched banks are Bank of India will be 6th largest with Rs 9.03 lakh crore business, Central Bank of India with Rs 4.68 lakh crore business, Indian Overseas Bank, with Rs 3.75 lakh crore business, UCO Bank, with Rs 3.17 lakh crore business, Bank of Maharashtra with Rs 2.34 lakh crore business, Punjab and Sind Bank with Rs 1.71 lakh crore business.

Without the reorganization of the above banks, the task is not yet complete. Hence, the Government is in the process to complete before six months from the end of the financial year, so that it can be executed from 1st April 2021. A select group of top government officials has already started talks on the proposal, and it seems it was to privatize the Banks. In an attempt to make the public sector banks stronger, the government is examining the possibility of privatizing Punjab & Sind Bank, Bank of Maharashtra and Indian Overseas Bank, which were left from the current consolidation program, during the year 2019.

The Business figures of the three banks as on 31st march 2019 (in crores) is as follows:

| ITEM | NAME OF THE BANK | DEPOSITS | ADVANCES | INVESTMENTS | PROFITS | NON PERFORMING ASSETS |

| 1 | Punjab and Sind Bank | 98558 | 69176 | 26173 | 1397 | 8606 |

| 2 | Bank of Maharashtra | 140650 | 82666 | 59697 | 2198 | 15324 |

| 3 | Indian Overseas Bank | 222534 | 132598 | 66932 | 5034 | 33398 |

The question is what the government will achieve through these mergers or privatization? The creation of large banks to meet the requirements of the economy is a necessity. Larger Bank will be capable of facing global competition. The merger will reduce the cost of banking operation. Merger will also result in better NPA and Risk management. Merger will help in improving the professional standards. Decisions on High Lending requirements can be taken promptly. And in the global market, the Indian banks will gain greater recognition and higher rating. With a larger capital base and higher liquidity, the burden on the central government to recapitalize the public sector banks, again and again, will come down substantially.

In the name of banking reforms measures, the Government wants de-nationalisation, privatisation and handing over the public sector Banks to the private corporate vested interests. The Government is pursuing the policy of mergers and amalgamation of Banks, though there was absolutely no need. Public Sector Banks are nation building institutions. If PSU banks are privatised there will be no social obligation and only profit making will be the motive. Privatisation won’t solve problems, because the rate at which non-performing assets are increasing in banks, including private sector banks. It will be too dangerous to leave banking in the hands of business houses.

Please recall the days prior to 1969, when Indian banking sector was in private hands. Indian government was then of the opinion that banks favour the rich and that the poor must also be given access to cheap credit. With this view, several banks were nationalized. It is a huge irony that the banks which were nationalized based on pro-poor agenda are today facing mounting losses because they have loaned out huge sums of money to the rich without proper diligence. Hence, unless there is credit discipline, the merging of healthy banks with weak banks may not really improve the health of the banking system as a whole.

(Author is a former Banker. Views expressed are personal)

Whether we accept it or not but Privatization is On as we have seen the fall of market shares of some PSBs in these last few years.Nice article about the Privatization and amalgamation of banks.