Gopabandhu Mohapatra

The fuel prices have been hiked for the 14th straight day (as on 20.06.2020). The Petrol prices are up by Rs 0.51 in Delhi and now stands at Rs 78.88. The Diesel prices hiked by Rs. 0.61 per litre and now stands at Rs 77.67 in Delhi. During the last fourteen days, the price of petrol has increased by a cumulative Rs 7.62 per litre, and diesel by Rs 8.28 per litre. It is pertinent to note that the retail prices of fuel were frozen for a record period of 82-days, as oil companies did not revise the price of the two products since March 16 to June 6th, on account of the ongoing pandemic.

Since mid-March, global oil prices have been at unprecedented low levels. The crude prices nosedived from an average of about $55 per barrel in February to $35 in early March and then falling to $20 by end of March, as demand slumped because of the pandemic. From that point, the prices have recovered to around $37 now.

India is the world’s third-biggest oil consumer and imports 82% of its oil needs. Our fuel requirements are outsourced and we are at the mercy of not only international market sources but also the strength of our currency. The prices of crude oil and petroleum products in the international market fluctuate on daily basis depending on several factors including demand and supply conditions in the world.

The oil price hike can be attributed to three main factors (a) hike in the international price of crude, (b) fluctuation in the dollar and Indian currency ratio, and (c) some of the tax issues. Oil marketing companies (OMCs) are permitted to determine the retail price of fuel based on the currency exchange rate and fluctuations. There is a practice of revising fuel prices daily at 06:00 a.m. since June 2017, known as per dynamic fuel price method.

Although, there is a steep cut in retail prices of petrol and diesel, yet government used this opportunity to fill up its coffers and the pump prices for the consumer has barely changed. But when the reverse happens, consumers are forced to pay up more. Hence, the government gets to encash the upside while the consumers have to make good the downside.

Taking advantage of a reduction of crude price, excise duty on fuels was hiked by the Centre on May 5, instead of providing relief to the consumers. The Centre announced one of the steepest ever hikes in excise duty by Rs. 13 per litre on diesel and Rs 10 per litre on petrol. With the revision in excise duty, the government is collecting around 260 per cent taxes, (Excise Duty and VAT) on the base price of petrol and 256 per cent in the case of diesel.

While the government claimed that the impact of the hike was not passed on to consumers and absorbed by the Oil Marketing Companies (OMCs), the consumer, however, did not benefit from this fall in crude oil prices, when it was in record low level. Arithmetically, every Re 1 reduction in taxes per litre of fuel causes Rs 13,000 crore annual loss to the exchequer, yet the Centre nor the states have the financial strength or the willingness to take this hit. Alternatively, as and when oil prices increase, it is passed to the public. Citizens (Indian middle class) feel angry about the increase in the price, but finding no alternative, they keep quiet.

If we look back to 2004-05 when the prices of petrol/diesel were regulated and Oil Bonds were issued by the governments to the Oil Marketing Companies (OMCs) for the subsidies extended on petrol/diesel & other oil products. Governments used to issue oil bonds as compensation to these companies which are like government securities. Oil bonds worth Rs 1.44 lakh crore were issued by the UPA government, which left behind a debt burden. However, subsidies were soon done away with by NDA government.

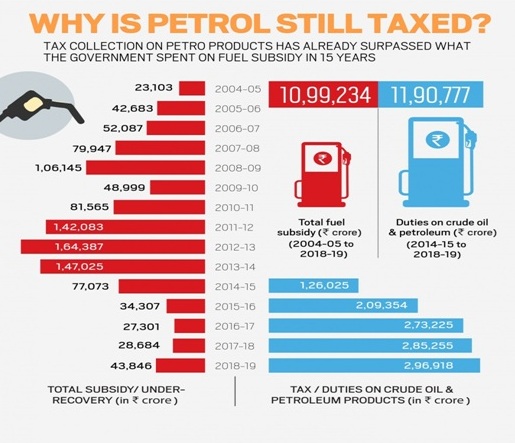

Since NDA government took over in the year 2014-15, the central government, started collecting taxes on petroleum products and has raked in around Rs 11.9 lakh crore, which surpassed the amount spent by it on fuel subsidies. As against that during this last 15 years, the total fuel subsidy from 2004-05 to 2018-19 was Rs 10.99 lakh crore. When the one-nation-one-tax regime of GST was implemented in July 2017, five petro-products – petrol, diesel, crude oil, natural gas, and aviation turbine fuel (ATF) were kept out of its purview for the time being. It seems neither Central government nor any of the states are in favour of Petrol, diesel price to come under the purview of Goods and Services Tax (GST) on the fears of heavy revenue loss.

As fuel is still out of GST, raising duties is easier for both the centre and states. As Centre doesn’t have the money to compensate states for loss of revenue and so the solution is to have a peak rate of tax plus allowing states to levy some amount of VAT. If we go back to the historical data of Petrol Price, it was less than 30 paise back then in 1947, whereas Petrol price today costs around Rs. 78.88 per litre (including GST). Let us have a look at the retail price of Petrol and diesel since 1989.

| YEAR | PETROL | DIESEL | YEAR | PETROL | DIESEL | |

| Apr 1989 | 8.50 | 3.50 | Apr 2006 | 43.51 | 30.47 | |

| Mar 1990 | 9.84 | 4.08 | Feb 2007 | 42.85 | 30.25 | |

| Jul 1991 | 14.62 | 5.05 | Feb 2008 | 45.52 | 31.76 | |

| Sep 1992 | 15.71 | 6.11 | Jan 2009 | 40.62 | 30.86 | |

| Feb 1994 | 16.78 | 6.98 | Feb 2010 | 47.43 | 35.47 | |

| Jul 1996 | 21.13 | 9.04 | Apr 2011 | 58.50 | 37.75 | |

| Sep 1997 | 22.84 | 10.34 | Apr 2012 | 65.60 | 40.91 | |

| Mar 1998 | 22.84 | 10.25 | Apr 2013 | 66.09 | 48.63 | |

| Jun 1998 | 23.94 | 9.87 | Apr 2014 | 72.26 | 55.48 | |

| Feb 1999 | 23.80 | 9.94 | Apr 2015 | 60.49 | 49.71 | |

| Jan 2000 | 25.94 | 14.04 | Apr 2016 | 59.68 | 48.33 | |

| Mar 2001 | 28.70 | 17.06 | Jul 2016 | 62.51 | 54.28 | |

| Jan 2002 | 27.54 | 17.09 | July 2017 | 63.09 | 53.33 | |

| Jan 2003 | 29.93 | 19.07 | July 2018 | 75.55 | 67.38 | |

| Jan 2004 | 33.70 | 21.73 | July 2019 | 72.96 | 66.69 | |

| Jun 2005 | 40.49 | 28.45 | June 2020 | 78.88 | 77.67 |

Worldwide, the cost of petrol, which averages $1.09 (Rs. 85/-) per litre according to GlobalPetrolPrices.com, differs wildly depending on where you are. So far as other countries are concerned, in Germany and Italy taxes on fuels as a percentage of pump prices was around 65 per cent of the retail price, 62 per cent in the UK, 45 per cent in Japan and under 20 per cent in the US.

Let us examine the Global rates as on September 16 2019. In Venezuela – Believe it or not, petrol is virtually free, Cuba – cost per litre – Rs 6.38, Sudan – cost per litre – Rs 9.93, Kuwait – cost per litre – Rs 23.83, Algeria – cost per litre – Rs 24.83, Pakistan – the cost of petrol is relatively lower at Rs 51.09 per litre, Norway – cost per litre – Rs 132.71, Barbados – cost per litre – Rs 134.13, Iceland – cost per litre – Rs 134.83, Hong Kong – cost per litre – Rs 160.39.

Government of India needs planning to bring petroleum products within the ambit of GST so that India’s fuel prices will match international rates. People would treat oil as just another commodity, which depends on international prices. It is essential to reduce excise charged by the Centre and VAT charged by the states. Hence, the government must prioritise and go for real solutions.

Petrol and diesel will get cheaper if taxed under GST. It will be better for the Indian economy and sooner or later bring petrol and diesel under the GST regime. Else, the high fuel price, which is causing severe hardships to the common man, will have a cascading effect on goods and services.

Lastly, there is a need to create awareness among people about the importance of natural resource – how precious natural resources are for us and for our future generations. People should be aware that crude oil is very limited inside the earth and it is a non-renewable resource. So it is our responsibility to preserve it for our future generation and should use it as minimum as possible and consume in a sustainable way.

Very well explained by various facts and figures from past data and the price fluctuations of fuel can be easily known by the chart given in this article. So as of now we can just focus on sustainable development.