Prof. Raj Kishore Panda

At this stage it is not reasonable to revert to self-reliance as a policy for economic pursuits leaving free trade as a drive to economic growth

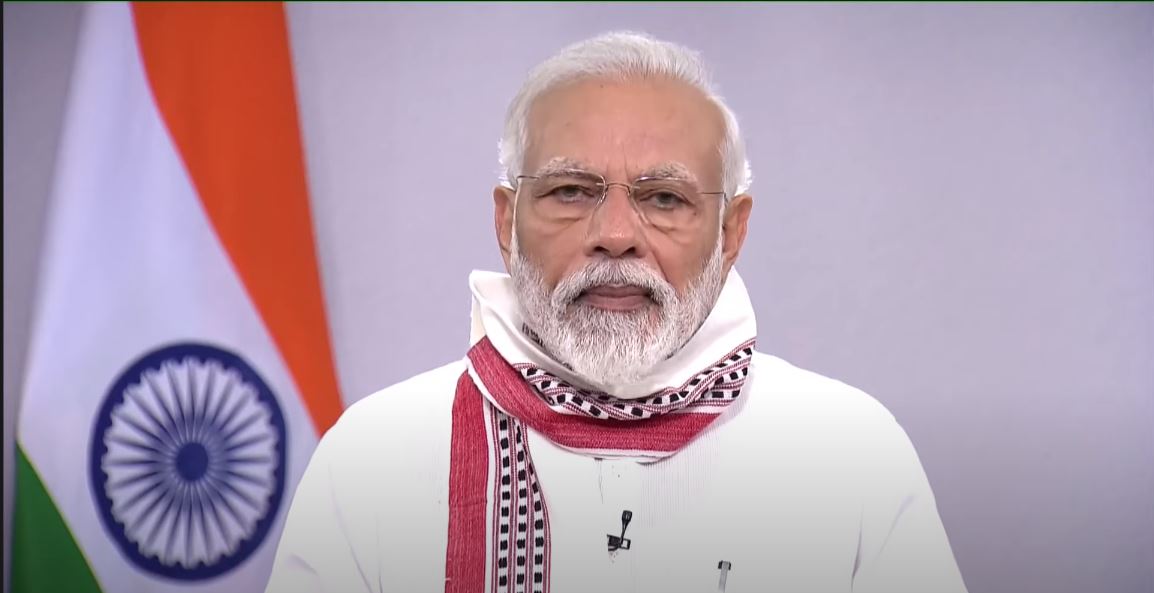

The Prime Minister’s address to the nation on 12th May, 2020 announcing “Atmanirbhar Bharat Abhiyan” and simultaneously releasing an economic stimulus package of RS. 20 lakh crore to revive the economy presents a positive note to the Indian economy deeply affected by corona-led lockdown. The Prime Minister’s vision of Atmanirbhar Bharat Abhiyan /self-reliant India envisages that India should not only produce to meet its own domestic needs but also cater to the global supply chains.

This suggests that Indian firms should promote better products so as to increasingly share the global market. It is no doubt a laudable proposition. But the Prime Minister’s call for raising India’s competitiveness using the stimulus package at this hour has sparked criticism by many. The ability of the economic package to provide adequate and immediate relief to the distressed sections of the economy and stem the rapid fall in India’s GDP growth is questioned.

Let me explain why this package is seen as inadequate. In the first place, it is not the quantum of stimulus package but its composition that matters at this critical situation. The present situation demands huge cash spending by the government so as to revive consumption demand. But as we see the composition of the stimulus package, is found to be more indirect and credit linked than the direct cash transfer by the government. Of the total amount of Rs. 20 lakh crore, a large part of it, that is Rs 8.04 lakh crore was provided by RBI in the form of additional liquidity into the system through various measures announced earlier.

More so, Rs.1.7 lakh crore of the stimulus package was also announced earlier (26th March) by the finance minister as relief under Prime Minister Garib Kalyan Yojana. Hence, of the remaining Rs.10.26 lakh crore whose details were given by the finance minister covering different sectors, the direct cash component spending by the government towards the most vulnerable sections such as daily labourers including migrant workers, widows, disabled, urban and rural poor etc works out to very meager (hardly 1.5 % of GDP) and thus inadequate to counter decline in their income resulting from lockdown.

Secondly, as reported by different media, the Indian economy which was slowing down before the onset of the pandemic has been severely hit by the sharp fall in the economic activities due to the imposition of nationwide lockdown. Measured in money value, the total output loss inflicted on the economy, as has been estimated by the State Bank of India Research Report on April 8, 2020 shows that the lockdown has put a break on almost 70 percent of the economic activities amounting an output loss of Rs.8.04 lakh crore.

Since the SBI’s estimation was based on the initial 21days lockdown period which has been subsequently extended thrice up to 1st June ( a total of 68days), the total amount of output loss will be more than threefold (Rs.25 lakh crore approx. ) of the estimated figure of SBI. From 1st June though there has been partial easing of the lockdown in the country yet due to rapid spread of the virus in several strategically important areas in most recent days, the business activities continue to remain subdued in the country as a whole.

This will add to the already output loss in the economy. Since the output loss of covid-19 being a function of the magnitude and speed at which the virus spreads and duration over which it lasts within the country, the total amount of output loss will be huge for the country.

Thirdly, while estimating the economic cost of corona virus, there are reports by many agencies which reveal that it will be massive across the world. In case of India even before the onset of the pandemic, the economy showed sign of slowing down with real GDP growth rate of 4.7 percent in third quarter and 4.2 percent in the fourth quarter of FY 20. Given the uncertain future most observers have projected a deeper contract in GDP growth rate during the 21FY than 20FY.

The Reserve Bank of India Governor Shaktikanta Das has endorsed this view and has forecasted a negative GDP growth rate for 21FY. Since the deceleration in the growth rate will be across sectors, this will lead to a fall in income leading to a cut in the expenditures both for households and corporate sector. Taking into account the uncertainty ahead the businessmen will postpone investment further. Since the Government expenditure is supposed to remain steady in this critical situation, the effectiveness of the government spending in raising purchasing power of the poor depends upon how much cash is reaching them.

The concept of Self-reliance is not new to the Indian economy. All through the country’s five-year plans, self-reliance was accepted as one of the goals of India’s economic policy. However, the country could achieve a low GDP growth rate of 3.5 percent on an average between 1950s to 1980s. It was only after the adoption of the Policy of Liberalization in the 1990s the country’s growth rate has doubled (about 7 % over the period 1990-2012). Since the adoption of New Economic Policy, the Indian economy has become a part of the world’s fast growing economies.

No doubt, the outbreak of COVID19 has given a big jolt to the economy, yet in the present situation when it is difficult to know how long the COVID-19 crisis continues in the country and the extent of government (both central as well as states ) spending required to counteract the downward spiral of the economy, Atmanirbhar Bharat package is likely to do little in rebuilding India’s economic growth.

(Prof. Raj Kishore Panda is an economist and the former Prof. of Economics, Utkal University, and former Director, Nabakrushna Choudhury Centre for Development Studies, Bhubaneswar.)