Pradeep Kumar Panda

India has always been viewed as a powerhouse and now is one amongst the top ten fastest growing economies from past three years which is clearly a result of various reforms & policies like Make in India, Housing for all, etc, launched by the Government of India. Prime Minister Narendra Modi, after coming to power in 2014, had set a target of breaking into top 50 EODB ranking from 142 that year.

The discussion has been carried out by using secondary data like reports from World Bank. The present paper tried to analyze the progress and current status of the EODB in India, discussing Indian business environment, comparing ease of doing business in BRICS nations and at last presenting challenges and suggestions in easing the business environment.

In the past few years, the government of India has launched several social & economic programs like the Make in India Campaign, Housing for all by 2022 & smart cities intending to transform & empower India economically & create jobs for young people. The Make in India program launched by Prime Minister Mr Narendra Modi in September 2014 recognizes that Ease of Doing Business is the most important factor in promoting entrepreneurs and simplifying the cumbersome process for everyday basic service. India became one of the top 10 improved countries with the rise to 100th position in 2017 from 130th the previous year, then 77th position in 2018 to 63rd position in 2021. Narendra Modi’s government celebrated this an emphatic endorsement of their economic reforms.

India aspires to be a five trillion dollars’ economy in the next five years. This ambitious feature has been reiterated by the PM and other leaders many times. Though this vision has definitely suffered a jolt due to COVID 19, changing international opinion in this pandemic era shows signs of opportunity for India. The “Make in India” programme can be seen as a flag bearer in this direction. We can see the news coming about the offering of land “twice to that of Luxemburg” to the companies planning to leave China after COVID 19. This looks possible but demands lots of hard work, concrete and bold labour, as well as financial sector reforms and huge investments in the infrastructure sector.

Concept of EODB:

The Doing Business report has its roots in a paper first published in the Quarterly Journal of Economics by Simeon Djankov, Florencio Lopez-de-Silanes, Rafael La Porta, and Andrei Shleifer called “The Regulation of Entry” in 2002. The paper’s main findings were that: “Countries with heftier regulation of entry have extreme corruption & larger unofficial economies, but no better quality of private or public goods. Conversely, countries with more democratic and limited governments have simpler regulation of entry.” This paper became widely known because it delivered quantitative evidence that entry regulation benefits the politicians and bureaucrats without adding value to the private sector or granting any additional protection. A low numerical value of the index, meaning a higher ranking, indicate simple and better regulations for business practices and more robust protection of property rights.

Launched in 2003, the World Bank’s Ease of Doing Business Report (EoDB) assesses business regulations across 190 economies. The annual report receives comprehensive coverage from the media and private corporations across the world. Even politically, an improvement in a nation’s ranking is projected by the national governments as a significant economic achievement. Though the evaluation by the World Bank is not the only one published to indicate relative openness of the business environment in economies, the annual EoDB ranking is often cited as the most accurate indicator of the regulatory environment for business operations.

The term has been defined to indicate the positive and negative aspects of any country’s economic life, which contributes to and hinder the development of a healthy business environment there. It underlines the necessary steps that need to be taken to maximize those positive aspects and minimize the negative ones. Based on these aspects, the World Bank also declares annual rankings of various countries, thus acknowledging their business environment globally. It is a general opinion that the higher rank holders become the preferred choices of global investors for their stakes.

As per the different research papers, World bank reports, articles, books, and some significant constructs have played a vital role in promoting foreign investment. First-factor, i.e., “Starting a business”, relates to the smooth functioning of Government departments and steps like time taken in various clearances, land acquisition, single window systems, maintenance of law-and-order situation, the attitude of the general public, and those of administration etc. The fifth one, i.e., Getting Credit, owes its effectiveness to the healthy functioning of the country’s financial systems.

Though the land law has a role to play here, strengthening the financial institutions is a long drawn procedure and takes a considerable period. The third and eighth factor relates to infrastructure developments in the power sector, transportation in all forms, i.e., surface, air, and water. The products and services are ready on time and delivered on time at the proper destination. Trading across the borders also depend upon the country’s priority in its economic system, its political and commercial relations with other countries, the quality offered in the products and services, cost competitiveness etc.

Job Creation and Housing for migrant labourers:

India is the fastest moving emerging economy globally, growing more than 7% (average) in the post-Lehman era (2009-17). According to the IMF, India is a bright spot globally, and India’s growth is looking very lucrative in the coming years. India’s growth has surpassed many emerging and developing economies. Recent IMF data suggests that India is the fastest-growing economy globally, and this trend would continue in 2019 and 2020. The survey revealed by National Apex Chamber suggested that around 75% of the households had a family member who has been looking for a job, and around 64% of these households have been able to find a job. The private sector was the major employer of employment in the country, followed by government services and self-employed.

Make in India Campaign:

In India campaign launched by PM Narendra Modi on 25th September 2014, it can make a call to the topmost business investors all across the world for investment in India by providing them with an opportunity to set up their Business anywhere in the country. The programme focuses on building an adequate physical infrastructure for foreign companies to set up manufacturing units and help the digital network market in the country create a global hub for Business. This national make in India program was designed to transform the country into a global business hub. Because it contains attractive proposals for local and foreign companies, this campaign creates several valuable and honoured jobs. It is also providing skill enhancement in almost every sector for improving the status of youths of the country.

The government has recognized almost 25 critical sectors like aviation, chemicals, automobiles, IT, textiles, ports, pharmaceuticals, wellness, hospitality, tourism, and railways to work for the investors and become a world leader. Make in India is an ambitious long-term project, but it will help the country’s economic development. Make in India inventiveness has been highlighted at all key international events and has become the fastest and largest growing government initiative. This initiative would be a great source of employment both for men and women, educated & uneducated and help them amplify their standard of living, thereby leading a happy and peaceful life in a dignified way.

Land Acquisition:

Land acquisition is a critical first step in starting a manufacturing company. Developers must obtain the consent of 70% of landowners in the event of public-private partnerships and up to 80% of those whose land is acquired for private projects under the new law. The primary concerns linked with it, which may lead to conflict, are rehabilitation and resettlement. The Government need to acquire land for both private companies as well as public-private partnership projects. Under the new law, Public Private Partnership projects sanction has been reduced from 80 percent to 70 percent. In addition, only the consent of landowners is required.

Definition of Market Value is amended to ensure that acquisition price doesn’t form the basis for compensation calculation in future acquisitions. Earlier, there was a danger of a price spiral as (a multiple of) costs of first acquisition in an area would calculate land price for any subsequent acquisitions. The state to provide a sliding scale flexibility for fixing compensation in rural areas between 2- and 4-times market value, depending on their distance from urban areas, from the earlier 4 times market value compensation.

Labour Laws:

The introduction and implementation of many significant and crucial Labour reforms can be seen as a bold and diligent effort of the Government to ease the business environment. The development in the Labour sector regulates and facilitate compliance and promotes transparency and cost-effectiveness. Moreover, the Ease of compliance as notified by the Government enables setting up more enterprises, catalyzing more employment opportunities.

A significant drawback for the entrepreneur in starting a business in India is the complications involved in labour legislation and its compliances. With hundreds of state-level and central level labour legislations, it is the need of the hour to amalgamate, consolidate, simplify, codify and rationalize these laws. In this regard, the Government has succeeded in merging laws relating to the same subject matter under one umbrella. This is the most significant step towards promoting Ease of doing Business. Thus, the Government, as part of labour law reforms, has commenced a drive to rationalize 38 Labour Acts by framing four labour codes viz Code on Social Security, Code on Wages, Code on occupational safety, Code on Industrial Relations and health and wealth.

Promoting digitization through introducing a web-based inspection scheme, calling of information electronically, the composition of offences etc., promote a positive business environment. Efforts and contributions from various people have made us jump to the 63rd position among 190 countries. This means that last year, India improved its business regulations in absolute terms, signifying that our country is continuing its steady shift on the road to global standards. However, to reach a higher ranking in the Ease of doing Business and thereby creating a viable platform for the companies, it is pertinent to concentrate on various grey areas.

The minimum wage system has exploded over the past 70 years, with nearly 1,915 minimum wages for various job categories across states. However, the complexities make complying higher than the cost of violations. Aimed to reduce the number of laws and introduce uniformity in standards, the Code on Wages now subsumes four central labour laws: The Payment of Wages Act 1936, the Minimum Wages Act 1948, the Payment of Bonus Act 1965 and the Equal Remuneration Act 1976.

The new Wage Bill universally applies minimum wages and timely payments, regardless of sector and wage ceiling, allowing the central Government to take wage-related decisions for employment in some sectors, including mines, railways, and oil fields while allowing the state governments to decide the minimum wages for others. The bill also provides for the constitution of state and central advisory boards involving an equal number of employees and employers, independent persons and representatives of state governments.

Industrial Policies:

The search for industrial development began soon after the country gained independence in 1947. The Industrial Policy Resolution of 1948 established the policy’s basic contours, defining the government’s role in industrial development as both an entrepreneur and a regulator. This was followed by the comprehensive enactment of the Industries (Development & Regulation) Act, 1951 (referred to as the IDR Act), which provides the necessary framework for implementing the Industrial Policy and allows the Union Government to direct investment into desired channels of industrial activity, among other things, through the licensing mechanism, in accordance with national development objectives and goa.

The main objectives of the Industrial Policy of the Government are (i) to maintain a sustained productivity growth;(ii) to enhance gainful employment;(iii) to achieve optimal utilization of human resources; (iv) to attain international competitiveness; and (v) to transmute India into a major partner and player in the global arena. To accomplish these objectives, the Policy focus is on liberalizing Indian industry, allowing freedom and flexibility to the industry in countering the market forces, and providing a policy regime that facilitates and nurtures growth. Economic reforms initiated since 1991 envisions a significantly more significant role for private initiatives. The policy has been progressively liberalized over the years to the present, as would be evident in subsequent paragraphs.

New Industrial Policy, 1991:

The Government of India released the New Industrial Policy in 1991 in the country’s middle of severe economic instability. The previous regulations and licensing policies were responsible for more inadequate growth rate and BoP crises. The government faced the burden of perpetual losses, and the public sector industries had become inefficient. This new policy resolution of 1991 which aimed at easing up regulations and license controls of the industrial sector to pick up economic growth rate.

There are considerable disparities in industrial policy among the different states, owing to variations in social and economic infrastructure which in turn significantly influence levels of private investment. With the deregulation of private investments following the reforms in the 1990s, the states that were more advanced in industry managed to leapfrog, while the less industrialised states lagged even more.

The faster growth of the former, attracted more private investments, which only perpetuated the cycle by accentuating already existing regional disparities. States with poor infrastructure or poor governance are unable to attract private investments, to begin with. Therefore, proactive public policy, in the form of increased public investments or fiscal incentives, is crucial to the industrial development of such states.

Industrial Cluster:

A cluster is a geographically close set of interrelated enterprises and organisations in a specific industry that share common markets, worker skill requirements, technology, and buyer-seller connections. Industrial clusters are progressively recognized as an effective means of industrial development and promotion of small and medium-sized enterprises. The Ministry of Micro, Small and Medium Enterprises (MSME) implemented the cluster approach as a critical strategy for enriching the productivity and competitiveness and capacity building of small enterprises.

Effective Cluster management has gained immense acceptance amongst policymakers as an essential tool of intervention. Recognizing this, Aggregation and Clustering is one of the identified areas for focus in the National Manufacturing Plan (NMP).

Multiple bodies are associated with Cluster development initiatives. For example, various central ministries run multiple schemes related to cluster development. Given the multiplicity and importance of these enterprises, they would benefit from practical knowledge and creating a shared repository of theoretical related to cluster development and cluster management.

The Cluster Simulation Cell (CSC) play the role of creating, disseminating and recording helpful information and practices on better Cluster management. The country must improve the manufacturing capability of its MSMEs since it is from these small and medium units that tomorrow’s large enterprises would emerge to boost the country’s industrial growth.

Challenges of MSME Sector

Accepting a long-standing demand of the sector, the government approved a change in MSME definitions. As per the new definitions, a micro enterprise is a business with an investment of not more than Rs 1 crore and a Rs 5-crore turnover, a small unit is one with an investment of not more than Rs 10 crore and a Rs 50-crore turnover, and a medium unit is one with an investment not exceeding Rs 50 crore and a Rs 250-crore turnover.

A cluster approach can help firms achieve competitive advantage by promoting competitiveness. Cluster development enhances the competitiveness of the industry. Instead, it also acts as an instrument for alleviating poverty, generating sustainable employment, fostering innovation, enabling better, effective, and seven sustainable credit flow, thus addressing many of these challenges MSME enterprises face in India.

The Cluster Competitiveness Index (CCI) will evaluate and benchmark Clusters on various fields of performance and competitiveness, which will reveal the ability of Clusters to improve and innovate their productivity. It is an inter Cluster comparative index (CCI) that will highlight how Clusters (aggregate of Cluster units) compare against others in similar sectors or geographies.

Data on Cluster units and the Cluster will be recorded using the FACTS Framework to create the index. Awareness of the latest trends, technologies, and practices will increase amongst the CCI linked Clusters, and there would be a continuous incentive to benchmark, measure and improve their levels of performance on many fronts impacting their competitiveness and productivity.

Single Window Escort Service To Industries:

A prospective investor should get all his requirements and information to set up an Industry cleared through a Single Authority. The Department of Industry will offer this single window facility through a green Channel Committee of officials of all other concerned Departments to facilitate and expedite the various clearance and Government approval required by entrepreneurs. It can enhance the availability and supervision of information and simplify and accelerate information flows between trade and government.

It can also lead to better coordination and exchange of relevant data across government systems, resulting in significant benefits for all parties participating in cross-border trade. Finally, by making better use of resources, it can increase the efficiency and efficacy of official regulations while also lowering costs for both governments and merchants.

Single window enactment is a national level project which requires massive changes to the existing system and huge investments. Therefore, it impels government intervention, especially in the areas of policy formulation and financial assets.

Brand Development:

The need for economic growth is of principal concern to policymakers around the world. Nowhere is this issue of more importance than in developing nations. However, despite the best efforts of policymakers and their advisors, developing countries often suffer from the boom-and-bust economic cycles that cause consumer and investor confidence alike to suffer.

In the new age, brand management has become a central construct debated in the marketing field and the economy and other social disciplines (Ashworth and Kavaratzis, 2009, Kotler and Gertner, 2002). As a result, there are a growing interest and recognition in the brand management area and various necessities of international marketing strategies & conditions for changing dynamics of interdepended economies in the world (Kathman, 2002). Since this new form of economy is allied with globalization, the proliferation of services, fragmentation, the breakdown of boundaries, liberalization, and democratization based on digitalization, brands are becoming more important for all stakeholders and even for the national economies of those brands.

In this respect, with the higher level of inter-relations and competitiveness, businesses compete with the formation of more powerful brands to support their national economies in worldwide markets. Yet, the growing national economies that have more valuable brands accepted by global consumers are more powerful.

Customers are juggling more than ever before, according to Hunsaker (2020), and organisations understand a heightened demand for easing the Business: value with minimal hurdles, hassles, and fears. Essentially, it’s following through on your brand promise. Ease of Doing Business is a metric that measures how much your company benefits or hinders customers.

Ease of doing business measures value: benefits versus costs. The equation is known as Customer Experience Value Quotient. Concerning the customer’s perspective, it compares desired versus undesired outcomes. With the ongoing pandemic, customers are hyper-sensitive to companies syncing with their realities. Therefore, those who outrival in minimizing customers’ undesirable outcomes while maximizing customers’ desirable results will be rewarded.

Besides the advertising and marketing investments, R&D, economies of scale, the increase in TFP and intense competition are the central reasons for brand values’ long-term impact on GDP. All customer-facing aspects of a company’s performance – including product quality, production innovation and the underlying technology, product design, product cost, managerial know-how, human capital in the company, research, service, and other issues – have an impact on brand value, as well as on the company’s image and reputation.

Ease of doing Business Index:

The Ease of Doing Business score measures the difference between an economy’s performance and a best-practice standard across a selection of 41 indicators for ten Doing Business issues. (the labour market regulation indicators are excluded).

The World Bank provides ten factors that form the basis of its ranking to different countries regarding Ease of Doing Business (EODB). The derivation of the index has be directly taken

The types of ten sub-indices used to determine a country’s rating on the index are as follows:

Starting a business – Procedures, time, cost and minimum capital required to open a new business.

Dealing with construction permits – procedures, timelines, and costs of constructing a warehouse

Getting electricity – the methods, time, and expense involved in obtaining a continuous electricity connection for a newly constructed warehouse.

Registering property – Processes, duration, and cost of commercial real estate registration

Getting Credit – Strength of legal rights index, depth of credit information index.

Protecting investors – Indices for the amount of information disclosed, the level of director accountability, and the ease with which shareholders can sue.

Paying taxes – Taxes paid, hours spent preparing tax returns every year, and total tax payable as a percentage of gross profit.

Trading across borders – – The number of documents, the cost, and the time it takes to export and import them.

Enforcing contracts – Procedures, time and cost to enforce a debt contract.

Resolving insolvency – Under the bankruptcy proceeding, the time, cost, and recovery rate (percentage) are all calculated.

In every country, Doing Business does not measure all aspects of the business climate that are important to enterprises or investors, such as macroeconomic conditions, employment levels, corruption, poverty, or stability. It ignores the strengths and weaknesses of the global financial system as well as the financial systems of individual countries. It also doesn’t take into account the health of each country’s government’s finances. Other sorts of regulation that are essential to the private sector, such as financial market, environmental, or intellectual property restrictions, are not taken into account.

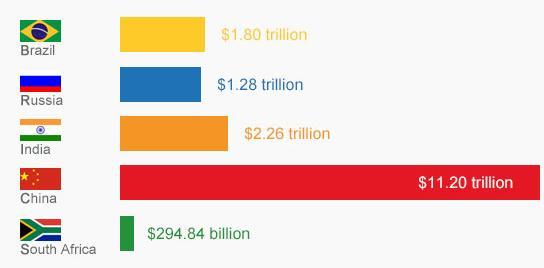

Comparing Doing Business in BRICS Nation:

BRICS nations have developed as a group with comparable features such as increased population, elevated growth rates and are coined as the world “s emerging economies. BRICS nations have shown variation in context of trade, manufacturing and the level of integration with the global markets. These nations are linked to each other in order to increase collaboration in different economic and financial fields. Nevertheless, owing to their respective demographics, opportunities and strengths, these developing economies have an assortment of similarities and dissimilarities.

As one study says, “China is the world “s workshop, Russia is seen as a gas station, India is the office, Brazil for raw materials and South Africa for Gold and resources.” Ranking of Russian Federation has successively improved from 40th rank in 2017 to 28th rank in 2020. Second in line we find China to be chasing the race of Ease of doing business from 78th rank in 2017 to 31th in 2020. On the other hand, South Africa is lagging behind with ranking of 74 to 84. Brazil has been more or less on the same position as evident from the table. Finally, the Indian economy has remarkably improved from 130th rank in 2017 to 63th rank in 2020.

Starting a Business

China has consistently improved the ranking of starting a business from 127th position to 27th Position in 2020. Moreover, it is evident that staring a business in China requires as low as 9 days. Brazil has improved the ranking of setting up of a business from 175 in 2017 to 138 in 2020. The number of procedures is 11 and number of days to set up business are 21 as per EODB, 2019. 9.South Africa has shown minor changes from 131 rank in 2017 to 139 rank in 2020. The number of procedures required in South Africa is seven and the time taken is 40 days in 2019. Russia has an added advantage of setting a business with 4 procedures and 10 days which is quite attractive. On the other hand, India still requires 10 procedures and takes 17 days to set up a business which sets back the overall rank to 136.

It has been recorded that China simplified pre-registration procedures and registration facilities which includes publication, notarization, inspection and other requirements. It is due to improvement in providing these services that has affected the rank for China with reference to starting a business. On the other hand India not only has cut or simplified post registration procedures like tax registration, social security registration and licensing procedures but it also introduced online platforms for the completion of these procedures recently to sync with each other in order to improve the rank for India.

Trading across borders

BRICS nations are having obstacles in trading across borders as a result the ranking for trading across the borders is ranging from 56 to 145. In case of China the number of documentary hours is 9 for export in comparison to South Africa which takes 68 hours. In case of India the number of hours for export compliance has reduced from 38 hours to 14.5 hours due to the changes in the foreign trade policy 2015-20. As per the trade policy, key shipping ports and airports shall be operating 24 x 7 to avoid delay of goods. Moreover, self-declaration at customs and single window clearance further has provided a major support.

Based on the overall rankings for cross-border trade, we discover that China, with a score of 56 in 2020, is considerably better at dealing across international borders. South Africa, on the other hand, is ranked 145th in 2020 due to the largest number of hours spent at customs for export compliance, which is 68 hours. There is need to improve upon the online procedures and infrastructure in Africa to improve upon the trade across the borders.

The 2020 report shows that India and China have been amongst the top 10 improvers. This is a commendable achievement because most of the other economies in the top 10 are significantly smaller economies compared to India and China. Chinese and Indian economies showed impressive reform agendas. The research to enhance the regulatory climate of company has taken place over several years, leading to China and India being among the top 10 improvers in the 2019 as well as 2020 EODB rankings. Brazil and South Africa need to focus on structural changes and reforms for improving the EODB. A study confirms that amongst BRICS nations the Russian foundation stands to be the first choice for MNCs based on EODB ranking.

The Challenges of doing Business in India:

India is undergoing unprecedented economic liberalisation, allowing international corporations access to its large consumer base. However, it is a notoriously challenging place to try and do Business, and having native assistance on board is the key to unlocking the country’s enormous economic potential. The Republic of India is a immense country with immense economic potential; however, traversing the various and complex corporate landscape is frightening while not the proper assistance on board.

A large, young population and a robust export sector expect increasing businesses, with a possible consumer base that outstrips most alternative nations within the developed and developing world. Political stability and broad agreement on reforms are also a giant pull for expanding corporate companies. The well-developed banking industry and dynamic capital market highlight the maturity of its economic structure. However, doing business in India will continue to be a difficult task, and having local support will make all the difference in a venture’s success. The following are the most significant problems in India’s Ease of Doing Business:

The Cost of Starting a Business: The expense of launching a business in India is exorbitant, and the procedures might be intimidating if you don’t have local knowledge. In the initial set-up, ten operations must be completed, costing 49.8% of total income per capita. On average, it takes roughly 27 days to complete the activities, which is significantly longer than the OECD average of 12 days.

Dealing with the Permits for Construction: Construction permits are similarly a costly chase, involving 34 procedures and taking upto 196 days. It takes around a month to get Intimation of Disapproval from the Building Proposal workplace and around a month long procedure in paying the fees, and NOCs should be sought-after from the Tree Authority, the Drain and Storm Water Department, the Electrical Department, the Sewage Department, the Traffic & Coordination Department, the environmental Department, and also the Chief Financial Officer.

Getting Electricity Connection: the cost of getting electricity in India is relatively cheaper compared to South Asia, but the number of processes involved can be somewhat daunting. Additionally, every procedure is quite restrictive, taking around eight days to receive associate external site scrutiny and three weeks to urge outwardly connected, having a meter installed and conduct a check installation.

Property Registering: Registering a property involves a lot of legwork and might result in significant fees when done all at once. The two expenses to watch out for are a 5% stamp duty on the property and a 1% charge on the property’s market price incurred at the Sub-Registrar of Assurances, however legal fees at the Land & Survey Office can also be a pain.

Credit Getting: India ranked 23rd in the world for Ease of Obtaining Credit, outperforming all other South Asian countries. According to a research by the International Finance Corporation and the World Bank, when India’s unified collateral registry, which is geographically consolidated, went live, it improved access to credit and the secured transaction regime.

Enforcing contracts and Protecting Investors: The notion of investor protection has garnered a lot of attention of late. New bodies such as the Securities & Exchange Board of India (SEBI) have been set up to that effect. India’s overall ranking in Enforcing Contracts is 163 by World Bank. Average days for enforcing contract is 1,445 and the recover amount is 31% of the value of claim. This is shocking.

Taxpaying attitudes: Firms in operation in India are required to form 33 tax payments a year, taking about 243 hours of price of attention. The headline corporation charge stands at 30% per unit. However, firms may also incur charges within a central sales tax, capital levy, dividend tax, vehicle tax, fuel tax, VAT and excise duty.

Taxpaying attitudes: Firms in operation in India are required to form 33 tax payments a year, taking about 243 hours of price of attention. The headline corporation charge stands at 30% per unit. However, firms may also incur charges within a central sales tax, capital levy, dividend tax, vehicle tax, fuel tax, VAT and excise duty.

Border Trading: Regardless the Republic of India opening its borders to international trade, there are still many obstacles to beat once importing mercantilism and to export merchandise goods. Many layers of bureaucratic forms build it challenging to manoeuvre product expeditiously, and firms should file a lengthy list of documents before moving products across borders.

Resolving Insolvency and Bankruptcy: The RBI identified 12 major loan defaulters on June 13, 2017, in areas where the Insolvency and Bankruptcy Code (IBC) was implemented. The legal action against these defaulters is taking a long time. The Republic of India takes 4.3 years to recover from financial bankruptcy, which is significantly longer than the South Asian and OECD averages. Business relationships are frequently slowed by the arduous court procedure.

Delays and Pendency of Cases: The Supreme Court, High Court, Tax Department, and Economic Tribunals are experiencing high levels of delays and pendency in economic cases, which is having a significant impact on the economy in terms of delayed projects, contested tax revenues, rising legal costs, and reduced investment in general.

The Role of Culture: India is a cultural hothouse, and business is more about building relations than presenting figures and sums. The polychromic culture can be challenging to adapt to for outsiders, and due diligence into the destination is necessary before travelling.

Suggestions:

Reduce the Red-tapism in bureaucracy: In India, we’ve got manner too several committees, bodies, and government organizations. Get obviate several of them. Modi has started the method already by doing away with useless relics, just like the Planning Commission.

Shift to E-governance: Most of the application process is made online, making sure almost everything could be done without running 20 different places. This will let entrepreneurs run their businesses with the government without having to visit the gargantuan offices frequenty. If a businessperson ever had to go to a government office, that is a serious failure.

Standard the labour laws: Several of our labour regulations were enacted when the British Crown taken power of India. It doesn’t make sense currently. There are, for example, labour laws that define where employees are allowed to spit and how often a facility must be painted. Obviate any legislation that are no longer in effect.

Speedy judicial system: Most businesses are uninterested in Indian courts and also the lengthy process. Add additional courts, additional judges and appearances to dramatically increase resolving disputes between corporate companies.

Conclusion:

Looking into Indian context, the economy is at the transition stage. The second stage economic reforms are being undertaken with caution. The recent COVID 19 menace has at least taught the lessons that self-sufficiency is a much-needed thing. Even consumption-based economic development concept is poised to change when the very survival of the human being is at stake. In such a scenario, when the economy is already at doldrums, massive reforms are the need of the hour in this emergency like situation. India may benefit from a large domestic market, and the efforts to improve the ease of doing business rankings may finally yield results, but there is still a long road ahead.

Due to improvement in providing these services like simplified pre-registration procedures and registration facilities, including publication, notarization, and inspection, that has affected the rank for China regarding starting a business. On the other hand, India cut or simplified post registration procedures like tax registration, social security registration, and licensing procedures. However, it also introduced online platforms to complete these procedures recently that in sync with each other has improved the rank for India. it is observed that the ease of starting a new business is linked to the least number of procedures required and completing them in the least number of days.

Transparency in the registration process also helps in the building the trust among the public and provides the required information to the potential investors on time reducing the cost of the starting a business and hence enhancing the overall efficiency of the system and thereby improving the ranks of the countries in the index of starting a new business.

(Author is an economist based in New Delhi. Views are personal)