OdishaPlus Bureau

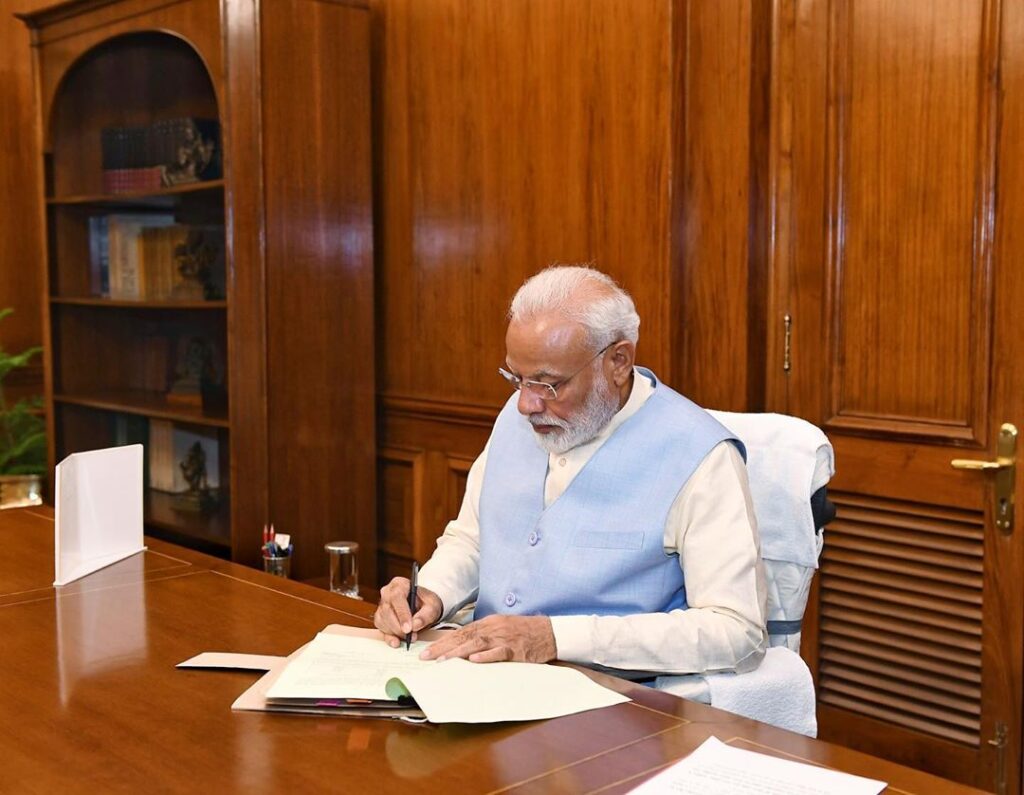

Prime Minister Narendra Modi on Wednesday held a meeting with the stakeholders of banks and NBFCs to discuss issues in the financial sector with major focus on credit growth and risk aversion. The important role of the financial and banking system of supporting growth was the topic of discussion. The small entrepreneurs, SHGs and farmers need motivation to use institutional credit to meet their credit needs and grow.

Risk aversion by banks has been a major concern of late as credit and liquidity are of much needed importance during the global Covid-19 pandemic. The Reserve Bank of India’s latest Financial Stability Report said that heightened risk aversion has pulled the overall credit growth rate of scheduled commercial banks to 5.9% on a year-on-year in March 2020.

During the discussion on Wednesday, the Prime Minister informed that the government is firmly behind the banking system and is ready to take any steps necessary to support and promote its growth. It was stressed that India has built a robust, low-cost infrastructure which enables every Indian to undertake digital transactions of any size with great ease and banks and financial institutions should actively promote the use of RUPAY and UPI among its customers. Further, the Prime Minister also reviewed the progress of schemes like emergency credit line for MSME, additional KCC cards, liquidity window for NBFC and MFI.