Gopabandhu Mohapatra

Father of the nation Mahatma Gandhi has said – A customer is the most important visitor on our premises. He is not dependent on us. We are dependent on him. He is not an interruption in our work. He is the purpose of it. He is not an outsider in our business. He is part of it. We are not doing him a favour by serving him. He is doing us a favour by giving us an opportunity to do so.

Yes, Customers are the most important part of a banking system and it is necessary that the bankers do not ‘squeeze’ customers. However, after saying this, we must understand that banking is not just a service but it is also a business and banks need to levy charges on services in order to survive.

Bank is a business and like any other business, banks make profit by earning more money than what they pay in expenses. The major portion of a bank’s profit comes from the interest that it earns on its assets and the fees that it charges for its services. To make a profit and pay operating expenses, banks charges for the services they provide.

RBI circular on Customer Service for banks has authorized banks to charge their service charges but has also advised to ensure that the charges are reasonable and not out of line with the average cost of providing the services. RBI has mandated all banks to display their charges on their website. You must visit the respective pages on your bank’s website to keep yourself aware with any new charges.

As you can see, there are a lot of charges associated with savings bank account. These charges would keep on growing every year as banks focus to earn more revenues from non-interest income.

Banks charge for a number of things. For example, many banks have minimum balance requirements. As per recent information, savings account holders have paid nearly Rs.10,000 crore to banks in the last three years towards penalties for not maintaining the minimum balance in their savings accounts. PSBs have collected Rs. 6155 crore and major private sector banks have collected about Rs.3567 crore.

Banks charge for a number of things. For example, many banks have minimum balance requirements. As per recent information, savings account holders have paid nearly Rs.10,000 crore to banks in the last three years towards penalties for not maintaining the minimum balance in their savings accounts. PSBs have collected Rs. 6155 crore and major private sector banks have collected about Rs.3567 crore.

Similarly, there are charges for duplicate bank statement, PIN generation, demand draft and even account balance updates that you get via SMS on your phone. There are other charges for things such as signature verification and demand drafts etc.

It is important to know all the fees the bank charges, as well as how to reduce or eliminate as many of them as possible. It all starts with an understanding of the fees that banks levy.

- Check account statements regularly for unexpected fees and make sure you avoid those fees / charges in the future.

- Meet minimum balance requirements if you can’t find an account with a “no minimum balance” requirement.

- Use a credit card – or the credit card function on your debit card – to avoid debit card transaction fees.

- Close unused accounts -When you move jobs you often leave behind a trail of unused accounts. There’s a good chance that such accounts have now fallen below the minimum amount balance limit and will attract charges. Check all these accounts, and if they have been inactive for a while, simply close them.

- Reduce dependency on cheques: Think twice before you write cheques. It may be better to use net-banking instead.

- Don’t be careless:Try and remember your card PINs. Many banks charge for regeneration of PIN.

- Go digital -Reduce dependency on paper statements. Quarterly account statements are provided free by banks. So are the monthly email statements.

- Also remember, every time you do an address confirmation, signature attestation, you are also charged.

- Use the ATM wisely – more usage of ATM in non-home ATMs are chargeable.

- Clear credit card bills on time – interest on outstanding balance is heavy.

- Never withdraw money with your credit card- the charges are heavy

- Opt for duplicate statements on email, else Banks charge a fee for issuing duplicate physical statements or passbooks.

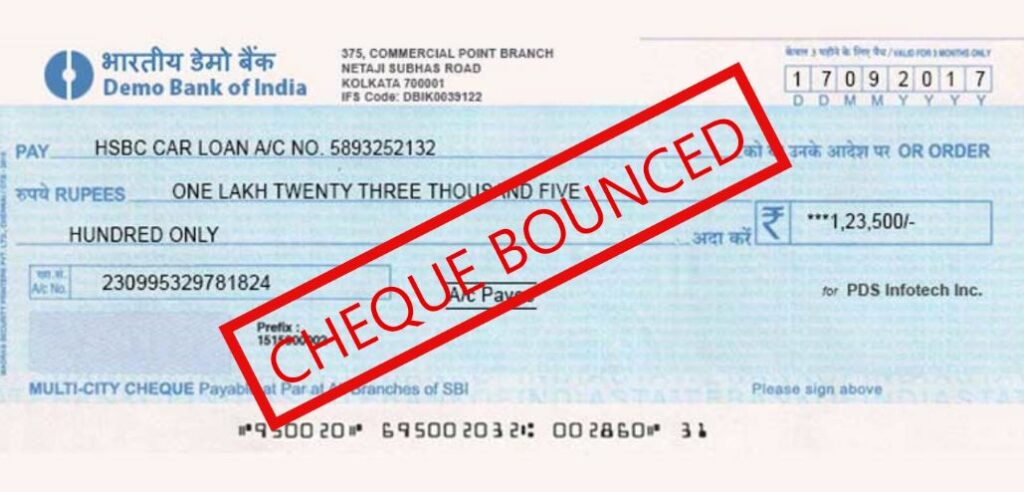

- Do not issue cheques when the balance is inadequate– cheque bouncing is a criminal offence and charges are heavy

- Closing Bank Account – banks also charge for closing of your account.

Since the list of charges is readily available on websites of banks, all of us should take a look at it to know what all we are required to pay for.

(Mr. Gopabandhu Mohapatra is a retired banker and writes on a variety of subjects with a focus on Banking and Finance. He can be reached at gopabandhumohapatra@yahoo.co.in)

Technology improved and staff reduced . Cost of banks on long run should have reduced. But rampant financing under priority sector and inability to recover the funds made banks compelled to make provisions and reverse the interest thus reduce profit. So banks see other way and find solution to increase profit. All these service charges required and not required are the brain child of all such situations.The vicious cycle of finance, non recovery, sevice charges veriety will make the life of simple customers , senior citizens, and technically not so savvy customers a very confused one. Let better sense prevail on all banks.

What an informative and nice article it is.This article clears all my doubt regarding the bank charges levied on us by the respective banks.This article makes us know that how can we reduce or eliminate different bank charges by giving us the valuable and important points regarding different factors.